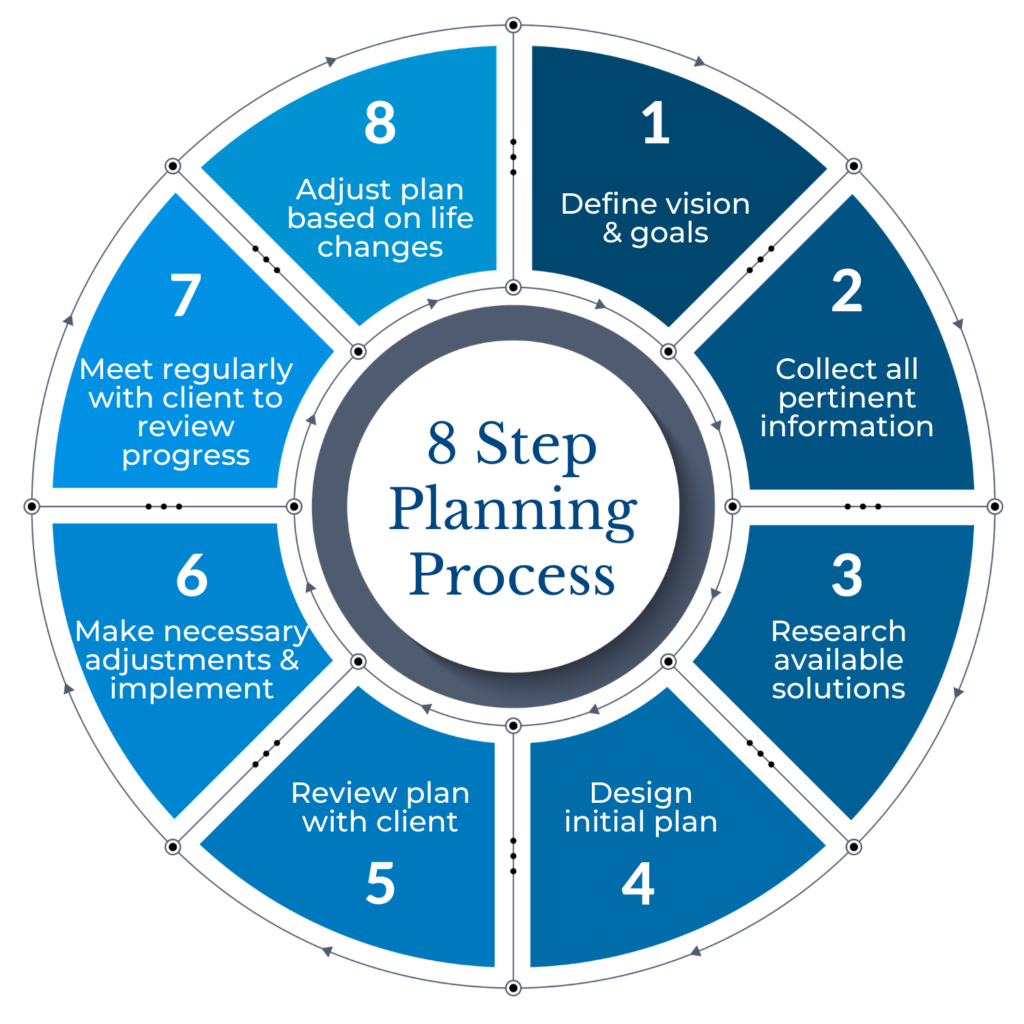

8 Step Comprehensive Financial Planning Process

What your Financial Plan will have

- Cash Flow & Net Worth Analysis

- Your Financial Health Check (Ratio Analysis)

- Risk Profiling & Asset Allocation Advise

- Review and Analysis of Existing Insurance Policies

- Review & Analysis of Existing Investment Products

- Goal based Investment Planning

- Protection Planning – Life, Health, Personal Accident Insurance

- Loans / Debt Management

- Retirement Planning

- Basic Estate Planning

- Basic Tax Planning

- Detailed Investment Advise and hand holding in Product Selection

- Three Months Hand Holding Post the Financial Plan submission for guidance

- Service Delivery – Online/Remote (Emails, Phone, WhatsApp, Zoom, Teams etc.)

- Implementation Support, Regular Reviews, Ongoing Monitoring and Advisory (OPTIONAL)

Lets Discuss in Detail

We are available for you round the clock. Visit our office for a cup of tea and we would love to talk and discuss about any or your requirements.. Book an Appointment now!!