Investing is as much about managing emotions as it is about making informed decisions. One of the most challenging emotions to keep in check is greed. While it’s natural to want the highest returns on your investments, this desire can lead to pitfalls that are often disguised as golden opportunities. The adage “If it seems too good to be true, it probably is” holds a lot of wisdom, especially in the world of finance.

The Allure of High Returns

Everyone dreams of multiplying their money quickly, and the promise of high returns can be irresistible. However, this dream often blinds investors to the risks involved. When an investment opportunity promises returns far beyond market norms, it’s essential to ask hard questions. Why is this opportunity offering such high returns? What risks are involved? Is the investment backed by credible assets or just empty promises?

Imagine a businessman in Mumbai who hears about an investment scheme offering 25% returns every month. It sounds like a dream come true. The promoters have flashy brochures, glowing testimonials, and a fancy office in a prime location. Without much thought, he invests a large part of his savings, believing he’ll double his money in no time.

But within months, the company stops paying, the office closes, and the promoters disappear. The businessman is left with nothing but regret. This story is not unique. Across India, from Delhi to Kerala, people are drawn in by the promise of quick riches, only to lose everything.

The Guwahati Scam: A Hard Lesson

Take the recent financial scandal in Guwahati. A stockbroking firm promised incredibly high returns, attracting thousands of investors. The firm quickly became well-known in the area, and many people believed they were on the road to wealth.

One of the victims was a schoolteacher who had saved Rs 50 lakhs for her daughter’s education. Trusting the firm’s promises, she invested her entire savings. But when the firm suddenly shut down and the director vanished, her dreams were shattered. Her daughter’s education plans were ruined, and her life savings were gone. This case is a stark reminder of what can happen when greed takes over.

Ponzi Schemes: Common Yet Devastating

Ponzi schemes have caused misery for countless people in India. In West Bengal, the infamous Saradha scam left thousands of investors penniless. A retired government employee from Kolkata invested his entire retirement savings, lured by the promise of doubling his money in just a few years. When the scheme collapsed, his dreams of a comfortable retirement vanished.

In Karnataka, a group of women pooled their savings into a chit fund that promised high returns. When the fund’s operator disappeared, their savings—meant for weddings and emergencies—were gone. These stories highlight the dangers of blindly chasing high returns.

In all these stories, there’s a common thread: the lack of sound financial advice. In the pursuit of high returns, many investors overlook the importance of having a trusted advisor.

Why you need an Advisor?

Think of investing like playing cricket. When you’re playing gully cricket with friends, you don’t need a coach—you can rely on your instincts and basic skills. But as you move up to district or national levels, where the stakes are higher, having a coach becomes essential. A coach provides guidance, helps you refine your technique, and keeps you focused on your goals. Similarly, in investing, while you might manage on your own with small investments, when you’re aiming for bigger financial goals, a trusted advisor is crucial. They offer expertise, strategic planning, and help you navigate the complexities of the market, ensuring you’re on the right path.

- Objective Guidance: A good advisor serves as a voice of reason, helping you stay focused on your long-term goals rather than getting swayed by short-term temptations. They can provide an objective perspective, guiding you away from emotional decisions driven by greed or fear.

- Expert Insight: Advisors bring expertise and experience to the table. They can analyze complex investment opportunities, identify potential risks, and recommend strategies that align with your financial goals. They stay updated on market trends and regulatory changes, ensuring your investments are well-positioned.

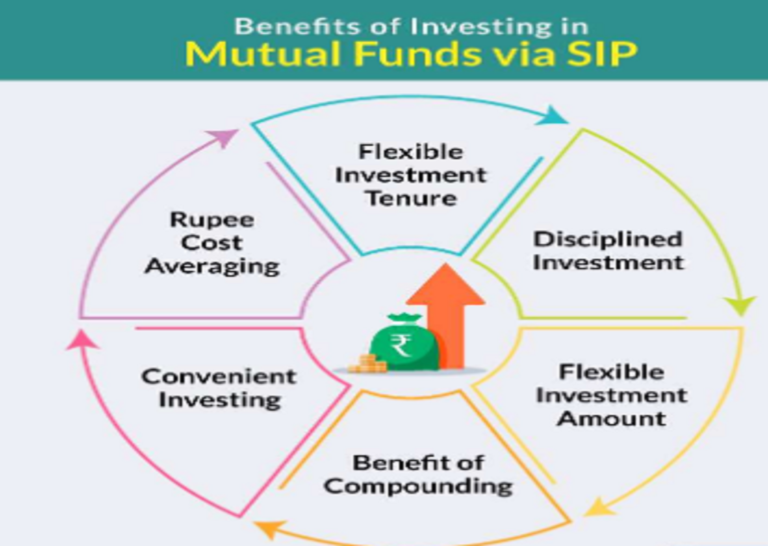

- Risk Management: Advisors help you build a diversified portfolio, spreading your investments across different asset classes to minimize risk. This way, even if one investment fails, your overall portfolio remains stable.

- Potential Scam Detection: In a country where financial scams are all too common, an advisor can help you steer clear of fraudulent schemes. They can identify red flags, helping you avoid too-good-to-be-true offers and ensuring your hard-earned money is protected.

How to Avoid the Greed Trap

So, how can you protect yourself from falling into the greed trap? Here are some tips:

- Do Your Homework: Before investing, research thoroughly. Look into the company’s history, read reviews, and verify their claims.

- Diversify Your Investments: Spread your investments across different assets to reduce risk. Don’t put all your money in one place.

- Ask Questions: If an investment promises unusually high returns, be skeptical. Ask where the returns come from, what the risks are, and whether the investment is backed by real assets.

- Know Your Limits: Understand your risk tolerance. Not everyone can handle the emotional and financial stress of high-risk investments.

- Learn from Others: The stories of those who lost everything serve as powerful reminders to prioritize safety and sustainability over quick profits.

Conclusion: Invest Wisely and Stay Grounded

The pursuit of high returns can be tempting, but as we’ve seen, it often leads to financial disaster. The key to successful investing is a balanced approach: do your research, manage your risks, and keep your emotions in check. Remember, if an investment opportunity seems too good to be true, it probably is. By avoiding the greed trap and working with a trusted advisor, you can achieve consistent, sustainable returns and protect your financial future.